Your clients in the cosmetics industry are facing huge shifts. You feel the pressure in their demands but might not see the full picture. This uncertainty makes it hard to plan ahead.

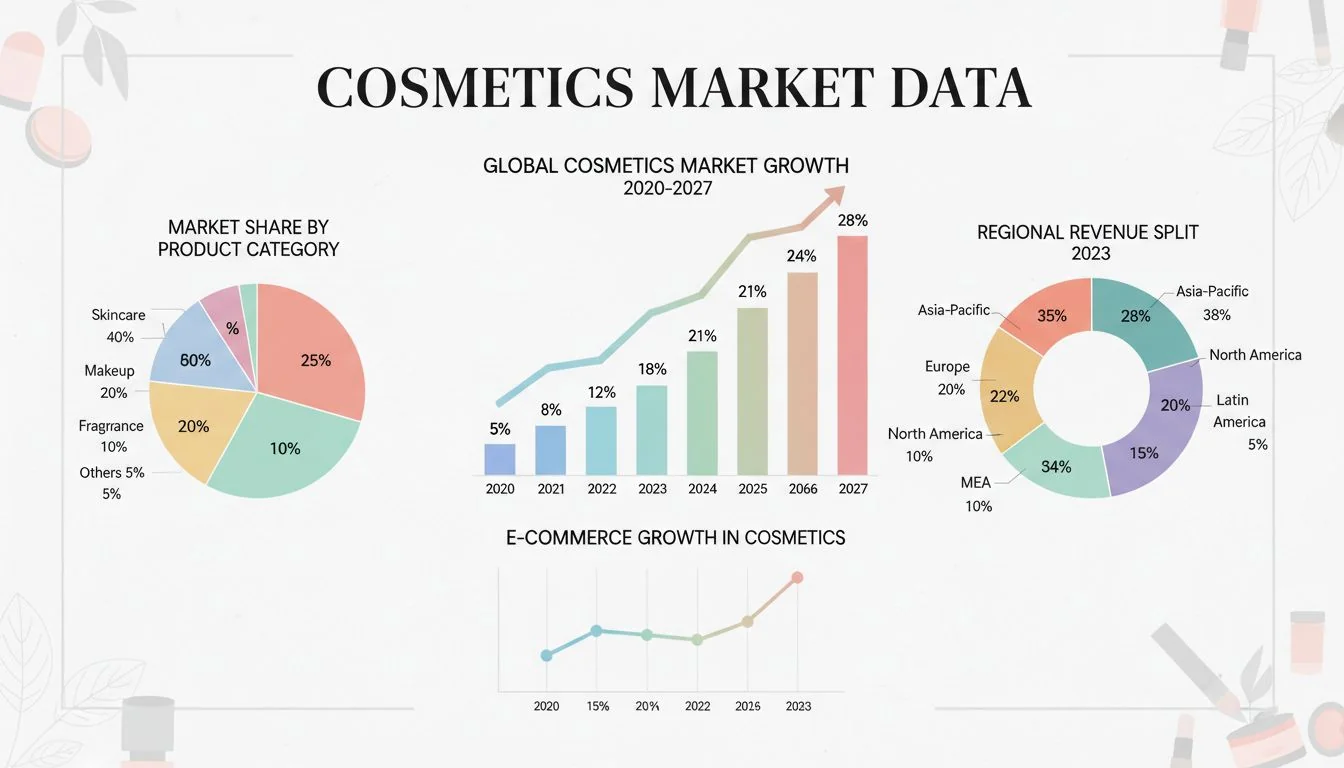

Cosmetics growth is shifting to value and compliance1. Expect ~5% annual beauty growth through 2030, led by skin care and rising online sales. EU microplastics bans will phase out certain polymers over 4–12 years, requiring reformulation and labeling. U.S. “cruelty-free” claims lack legal definition—use non-animal testing evidence. Winning brands prove visible efficacy, localize for India/Middle East, and balance store discovery with online replenishment.

When I started in this business, a good mold was all about precision and cycle time. Now, that’s just the beginning. The conversations I have with brand buyers and OEM partners are completely different. They’re not just asking "Can you make this part?" They’re asking, "Can you make this part compliant with EU regulations, from a sustainable material, that looks luxurious but costs less, and can you get us samples for the Indian market in two weeks?" These big-picture trends in the cosmetics world land directly on the desk of the mold designer. Understanding them is no longer optional; it’s essential for staying relevant and profitable. Let’s break down what these changes mean for us on the factory floor.

The global cosmetics market is projected to shrink by 5% annually through 2030 due to ESG regulations.False

This is false. The market is expected to grow about 5% annually, reaching roughly $590 billion by 2030. Regulations are changing the market, not shrinking it.

By 2032, the global cosmetics market is projected to be worth over $550 billion, with the Asia-Pacific region holding the largest share.True

Verified data shows the market is projected to reach $556.21 billion by 2032, with Asia-Pacific accounting for approximately 39.6% of the market share in 2024.

How are performance-first consumers rewriting product and packaging strategy?

Consumers are tired of marketing hype. They want products that show real, visible results and they are mixing luxury and mass-market items. This forces brands to prove their value, not just tell stories.

This "performance-first" mindset demands packaging that proves product efficacy. Brands need designs that look premium without a premium price tag, forcing mold designers to master advanced finishing techniques on cost-effective materials and create packaging that showcases the product inside.

Dive Deeper: From Founder Hype to Molded Proof

The shift away from celebrity-driven brands to "visible efficacy" directly impacts our work. Packaging is no longer just a container; it’s part of the proof. For a designer like Jacky, this means the mold design itself has to communicate quality and performance.

Packaging as a Showcase

When a product’s main selling point is its formula, brands want to show it off. This means a huge demand for crystal-clear containers. I’ve seen a big increase in requests for thick-wall PETG and SAN jars that mimic the look and feel of glass. This challenges us as mold designers. Achieving a flawless, glass-like finish requires immaculate mold polishing and careful consideration of gate location to hide any blemishes. It also means designing for materials that can be tricky to work with, demanding precise temperature control and pressure settings to avoid flow lines or cloudiness.

The "Masstige" Challenge

Consumers are now happy to "splurge" on a high-tech serum but "save" on a basic cleanser. This "masstige" (mass-market + prestige) trend puts pressure on us to deliver a premium feel on a tight budget. A client might want the heavy, substantial feel of a luxury cream jar but using a standard PP material. Our solution is in the mold design: using core-out techniques to create thick walls without excessive material, designing snap-fits that feel secure and satisfying, or creating molds for multi-part assemblies that give a more complex, high-end look.

| Consumer Behavior | Category Example | Implication for Mold Design |

|---|---|---|

| Splurge | High-Efficacy Serums, Anti-Aging Creams | Complex molds for dual-chamber bottles, airless pumps, clear thick-wall jars (PETG/SAN). High-polish finish is critical. |

| Save | Daily Cleansers, Basic Moisturizers | Standard or stock molds, focus on efficiency. Simple PP/PE bottles. Opportunity for clever design on stock components. |

| Mix | Buying both Tiers | Demand for "masstige" packaging. Molds must achieve premium look/feel (e.g., heavy feel, sharp edges) with cost-effective materials (PP/PET). |

Consumers now value a brand's celebrity founder more than the product's proven effectiveness.False

The trend is moving in the opposite direction. Consumers are increasingly skeptical of hype and demand 'visible efficacy' and proven results over a founder's story or celebrity endorsement.

Online sales channels for cosmetics are expected to grow at a CAGR of around 6.75% between 2025 and 2032.True

Data indicates that the online channel is a significant growth driver, with a projected CAGR of 6.75% as e-commerce becomes more central to beauty retail.

How do ESG rules translate into real-world R&D and packaging decisions?

New environmental rules, especially from the EU, are no longer suggestions. They are strict regulations with deadlines that directly affect product formulas and packaging. This creates urgent, complex problems for brands.

EU microplastic bans require phased reformulations over 4 to 12 years, depending on the product. This forces mold makers to test for material compatibility with new formulas and explore alternative, compliant polymers, which may have different molding characteristics like shrinkage and processing temperatures.

Dive Deeper: Your Mold, Their Compliance

For us in the molding industry, ESG isn’t just a buzzword; it’s a technical specification. The EU’s ban on intentionally added microplastics is a perfect example. When a brand has to reformulate a best-selling cream, it’s not just a chemistry problem. It’s a potential packaging nightmare.

The Material Compatibility Trap

I remember a client who reformulated their leave-on skin cream to comply with the new rules. The new formula was fantastic, but a month after launch, they started getting complaints of cracks forming in the jar. The new ingredients were causing environmental stress cracking in the polycarbonate (PC) they had used for years. We had to do a rush job to build a new mold cavity set optimized for PETG, a more chemically resistant material. This cost them time and money. Now, we advise clients to conduct rigorous material compatibility testing before finalizing a mold design for any new formula.

Designing for New Materials

The push for sustainability also means we’re working with a whole new library of materials—PCR (Post-Consumer Recycled) plastics, bio-polymers like PLA, and other biodegradable options. These don’t behave like virgin plastics. PCR content can affect flow and finish, while PLA has a completely different shrinkage rate and requires lower processing temperatures. As a mold designer, you have to account for this. You can’t just use the same design parameters. You need to adjust cooling channels, gate sizes, and shrinkage factors to ensure the final part meets spec.

| EU Microplastics Rule | Transition Period | Impact on Mold & Packaging Design |

|---|---|---|

| Rinse-off Cosmetics | 4 Years | Minimal direct impact on primary packaging material, but brands may switch to PCR to boost green credentials. |

| Leave-on Cosmetics | 6 Years | High risk of material incompatibility with new formulas. Requires testing of PP, PETG, SAN. Molds may need re-tooling. |

| Make-up, Lip, Nail | 12 Years | Longest timeline, but R&D is starting now. Expect demand for molds compatible with new bio-polymers and alternative materials. |

The term 'cruelty-free' has a strict legal definition in the United States, regulated by the FDA.False

This is a common misconception. The U.S. has no legal definition for 'cruelty-free.' Brands must be able to substantiate their claims with non-animal testing data to avoid misleading marketing.

The EU's ban on microplastics gives brands up to 12 years to reformulate certain products like makeup and nail polish.True

The regulation includes phased transition periods, with the longest (12 years) granted to makeup, lip, and nail products to allow for the complex R&D required for reformulation.

Where is growth happening now, and how do suppliers adapt?

The old maps for growth are being redrawn. While North America is still a huge market, the most exciting growth is happening in India, the Middle East, and other parts of Asia. But you can’t just sell the same product there.

Executives are prioritizing expansion into India and the Middle East. To win business, OEM/ODM suppliers and their mold makers must adapt by localizing designs, ensuring full compliance documentation, and providing fast-turnaround samples to meet regional expectations for shades, claims, and price points.

Dive Deeper: Molding for a Global Palate

When my company started helping clients expand into Asia, I learned quickly that a one-size-fits-all approach fails. What works in Toronto won’t necessarily work in Mumbai or Dubai. For mold designers, this means thinking like a local market expert.

Localization in Form and Function

In many parts of Asia, especially India, the "sachet economy2" is huge. Consumers prefer to buy smaller, single-use, or trial-size products. This means a greater demand for small, intricate molds for sachets, small tubes, and mini-jars. In the Middle East, where temperatures can be extreme, material selection is critical. A plastic that is stable in a Canadian winter might warp or degrade in a hot car in Riyadh. We have to guide our clients to use materials like PP or specific grades of PET that have higher heat deflection temperatures. It’s our job to ask these questions about the target market.

The Need for Speed

Brands entering these competitive markets need to be fast and agile. They can’t wait three months for a production-quality mold just to get samples. This is where rapid tooling3 has become a game-changer. We frequently create aluminum molds that can produce a few thousand parts perfectly. This allows the client to test the market, get feedback, and approve the design before committing to a costly steel production mold. A designer who can quickly turn a CAD file into a functional, high-quality sample mold is incredibly valuable to any brand trying to win in a new region.

| Growth Region | Key Buyer Expectation | Implication for Mold Design |

|---|---|---|

| India | Value pricing, smaller sizes (sachets) | Molds for small-volume packaging, cost-effective materials, efficient multi-cavity designs. |

| Middle East | Luxurious look, heat resistance | Molds for thick-wall packaging, high-end finishes. Material selection is key (e.g., heat-resistant polymers). |

| Asia-Pacific | Diverse shade ranges, innovative applicators | Molds for complex packaging with many small parts (e.g., compacts with multiple wells), unique applicator tips. |

| North America | Distribution focus, sustainability claims | Molds for e-commerce-friendly packaging (durable, lightweight), high use of PCR materials. |

China's beauty market is expected to continue growing at the same high rates it saw before the pandemic.False

While China may see a rebound, experts project its growth will be below the high pre-pandemic rates, leading brands to prioritize other regions like India and the Middle East for new expansion.

The Asia-Pacific region currently represents the largest market share for cosmetics globally.True

Data from 2024 confirms that the Asia-Pacific region leads the global cosmetics market with a share of approximately 39.6%.

How do you win in a world that is both digital and physical?

Brands can’t just rely on social media ads anymore. The digital space is too crowded and expensive. They need to win customers in physical stores and then make it easy for them to re-buy online.

Winning brands must create exciting in-store discovery experiences while using online channels for easy replenishment. For mold designers, this means creating packaging that offers a tactile, "unboxing" wow-factor while also being durable and efficient enough for e-commerce shipping.

Dive Deeper: Molding for Clicks and Bricks

The customer journey is now a loop between the physical and digital worlds. This "omnichannel" approach has specific technical requirements for packaging, which all start with the mold design.

The In-Store "Wow" Factor

Discovery still happens offline. A customer picks up a product, feels its weight, and opens the cap. That physical interaction can make or break a sale. I worked on a project for a luxury brand that wanted a unique "click" sound when the cap closed. This wasn’t an accident; it was a core design requirement. We spent weeks refining the mold tolerances for the cap and base to create that specific, satisfying sound and feel. This is where our craft becomes part of the brand’s identity. Molds that create unique textures, undercuts for interesting shapes, or parts for in-mold labeling all contribute to that critical in-store experience.

Designing for the Warehouse and Mailbox

Once a customer is won, replenishment often happens online. This means the packaging has to survive the journey from a warehouse to a customer’s doorstep. A leaky bottle or a cracked jar is a disaster for brand reputation. As mold designers, we are on the front lines of preventing this. This means designing robust threads for caps, calculating the right wall thickness to balance durability and weight, and selecting materials that can withstand drops and impacts. The rise of refillable packaging also presents a new challenge: designing pods and base systems that require extremely tight tolerances to ensure a leak-proof fit, time after time.

| omnichannel strategy4 | Packaging Feature | Implication for Mold Design |

|---|---|---|

| In-Store Discovery | Tactile textures, unique shapes, satisfying closure "click" | Complex mold surfaces (e.g., EDM texturing), lifters/sliders for undercuts, tight tolerance design for snap-fits. |

| Online Unboxing | Visually appealing, "Instagrammable" design | Molds for multi-part assemblies, unique silhouettes, compatibility with in-mold labeling (IML). |

| Online Replenishment | Durable, leak-proof, lightweight | Precise thread design, wall thickness analysis (FEA), material selection for impact resistance. |

| Refillable Systems | Refill pods, durable outer casing | High-precision insert molding, extremely tight tolerances to ensure a perfect, leak-proof seal between components. |

AI is now widely used by most cosmetics companies for all aspects of R&D and manufacturing.False

AI adoption is still in its early stages. While it's being used in specific areas like R&D, quality control, and social listening, widespread, end-to-end adoption is not yet the norm.

Inclusive marketing, such as offering a wide range of foundation shades, has been shown to impact consumer consideration and purchasing decisions.True

Consumer trend data shows that inclusivity is a key value driver. Brands that offer products for a diverse range of skin tones and types perform better in the market.

Conclusion

The cosmetics industry is changing fast. Understanding consumer values, new regulations, growth markets, and retail strategies is now a core part of a mold designer’s job to stay ahead.

References

-

Understanding value and compliance trends is crucial for brands to adapt and thrive in a changing market. ↩

-

Investigating the sachet economy can help brands tailor their packaging strategies to meet regional consumer preferences. ↩

-

Learning about rapid tooling can highlight its advantages in speeding up product development and market entry. ↩

-

Learning about omnichannel strategies can enhance customer engagement and drive sales across both physical and digital platforms. ↩